Avoid Common Payment Pitfalls

Learn how to avoid common payment pitfalls by understanding what successful businesses consider when working with a payments provider.

Learn More

Case Studies

Sage 100 Case Study - Go Home, Ltd

“As Go Home continues to grow their portfolio of offerings and client base, they realized they needed to differentiate themselves not just with their offerings, but also the way they service their clients. REPAY provided the best rates, next day funding, and an integration that had the same look and feel of Sage 100 - exactly what Go Home was looking for.” Eric Esterkin, COO of Go Home Ltd

Sage 300 Case Study - K & K Interiors

“The biggest challenge we were facing with a non-integrated payment solution was the time and labor dollars we were spending as we were growing fast and our process couldn’t keep up.” The previous credit card transaction process for K&K Interiors was very reliant on manual entry. As the company grew, they knew they needed to find a better process.

Acumatica Case Study - United Brokerage Packaging

“The biggest challenge we were facing with a non-integrated payment solution was the time it took to process credit card payments using an EMV terminal manually outside of Acumatica. Before implementing REPAY it would take approximately 20 minutes per transaction, and we were processing over 20 transactions a day.” Russ Williams, VP of Operations

YayPay Case Study - Top Notch Distributors

"The added bonus is that it also facilitates the payment process for our customer, it is easy for them to pay us via the link in the email we send them. They simply click the link in the email that will bring them into their customer portal and they are able to click on a couple of invoices to pay them via ACH or credit card. They can also view or download statements and invoices anytime they want." "We have seen double digital growth in our online payments” Tony Prudente, Controller of TND

Sage 300 Cast Study - Peachstate Audio

"The biggest challenge we were facing was that only one person at the company knew how to capture payments on the website, and if that person was on vacation... we don’t know what we would have done.” -Mary Beth O’Rouke, Business Development Manager

Sage 100 Case Study - Group Sales

"Another big feature REPAY has over other processors; your nightly capture and closing and depositing - 95% of those funds the next day, if not 100% of the funds." -Jason Ernst, Vice President of Operations

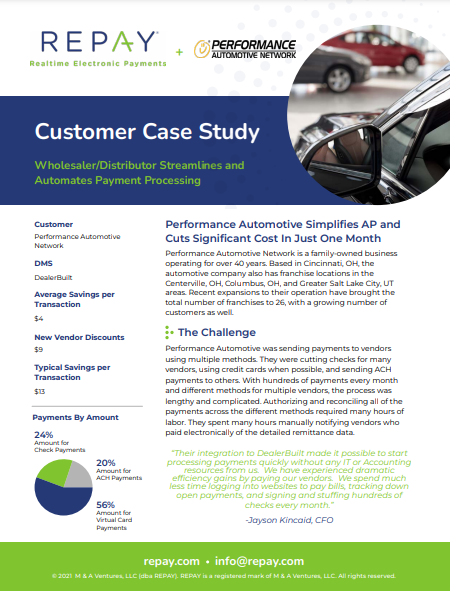

AP Vendor Payments Case Study

Performance Automotive Simplifies AP and Cuts Significant Cost In Just One Month.

Showing of results

Datasheets

Sage Integrations

REPAY works seamlessly with the following Sage solutions:Sage 100 cloud, Sage 100, Sage 300 cloud, Sage 300, and Sage Pro.

Sage 100

Integrated and Flexible. Work seamlessly within Sage 100 to avoid manual entry and reduce error with an integrated payment processing solution.

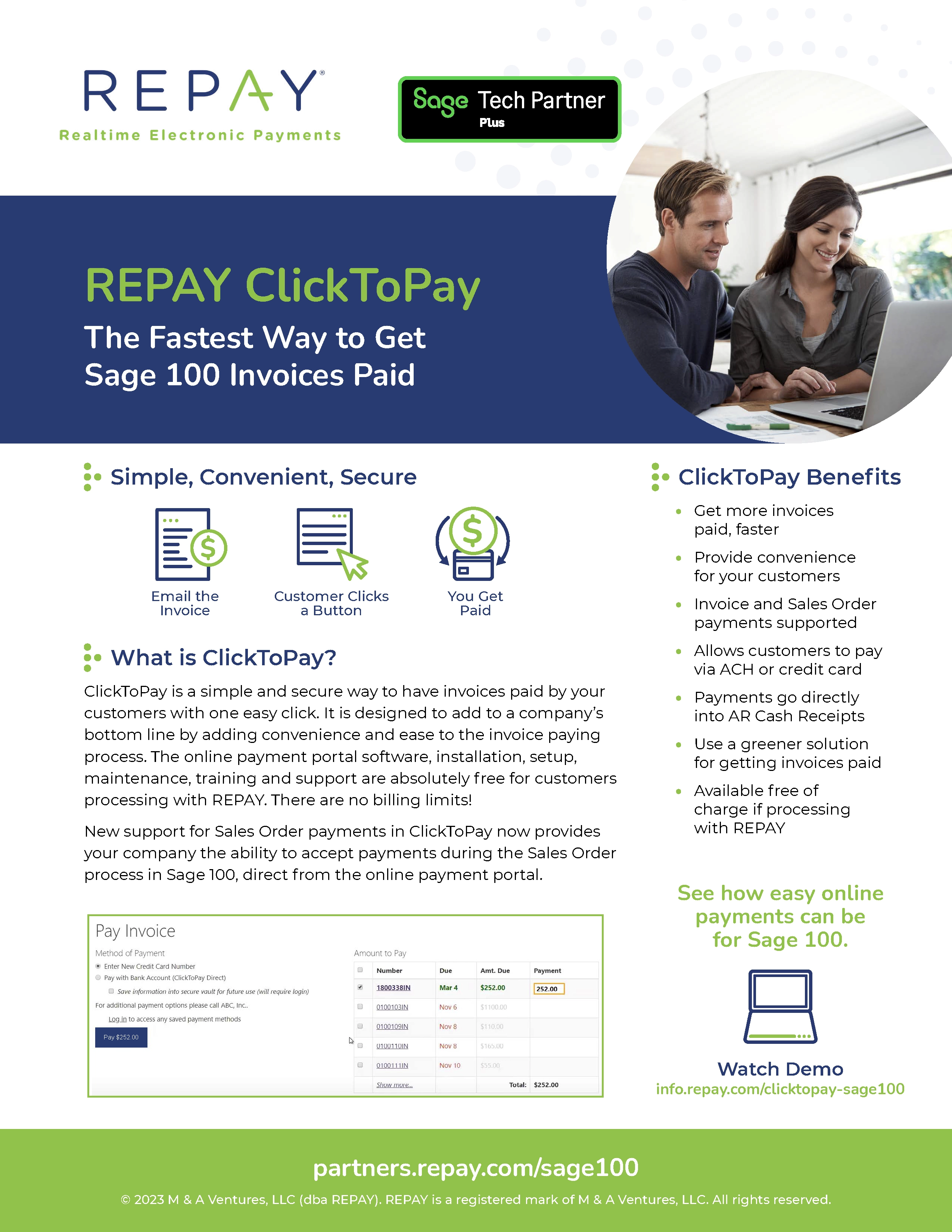

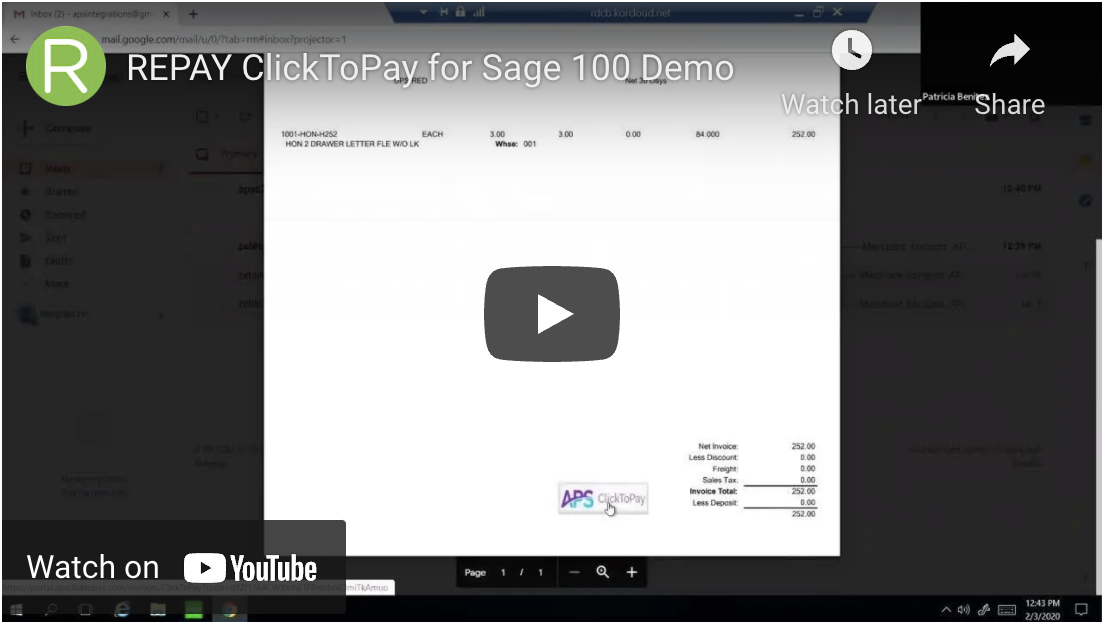

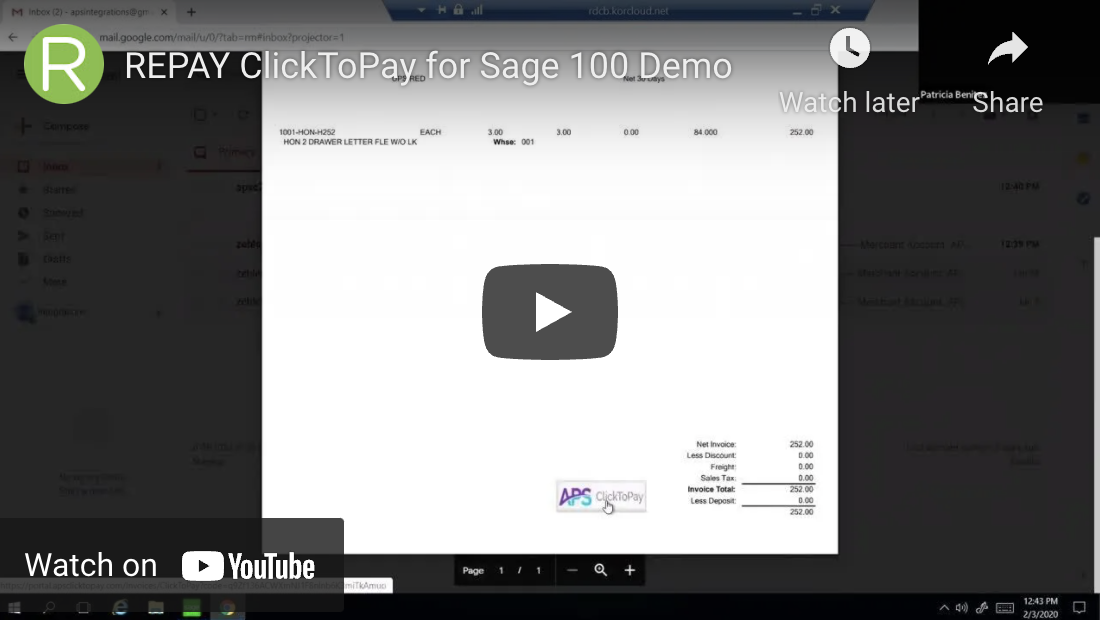

Sage 100 ClickToPay

ClickToPay is a simple and secure way to have invoices paid by your customers with one easy click. It is designed to add to a company’s bottom line by adding convenience and ease to the invoice paying process.

Sage 100 ClicktoPay and DSD InstaDocs Datasheet

ClickToPay is a simple and secure way to have invoices paid directly from Sage 100 to your customers. Simply send a copy of the invoice via email. Your customer opens the email and selects which payment method they would like to use.

Sage 100 Multi-Currency

REPAY and Multi-currency from DSD work seamlessly together for Sage 100.

Sage 300

Integrated and Flexible. Work seamlessly within Sage 300 to avoid manual entry and reduce error with an integrated payment processing solution.

Sage 500

Integrated and Flexible. Work seamlessly within Sage 500 to avoid manual entry and reduce entry error with an integrated payment processing solution for Sage 500.

Acumatica

Integrated and Flexible. Work seamlessly within Acumatica to avoid manual entry and reduce error with an integrated payment processing solution.

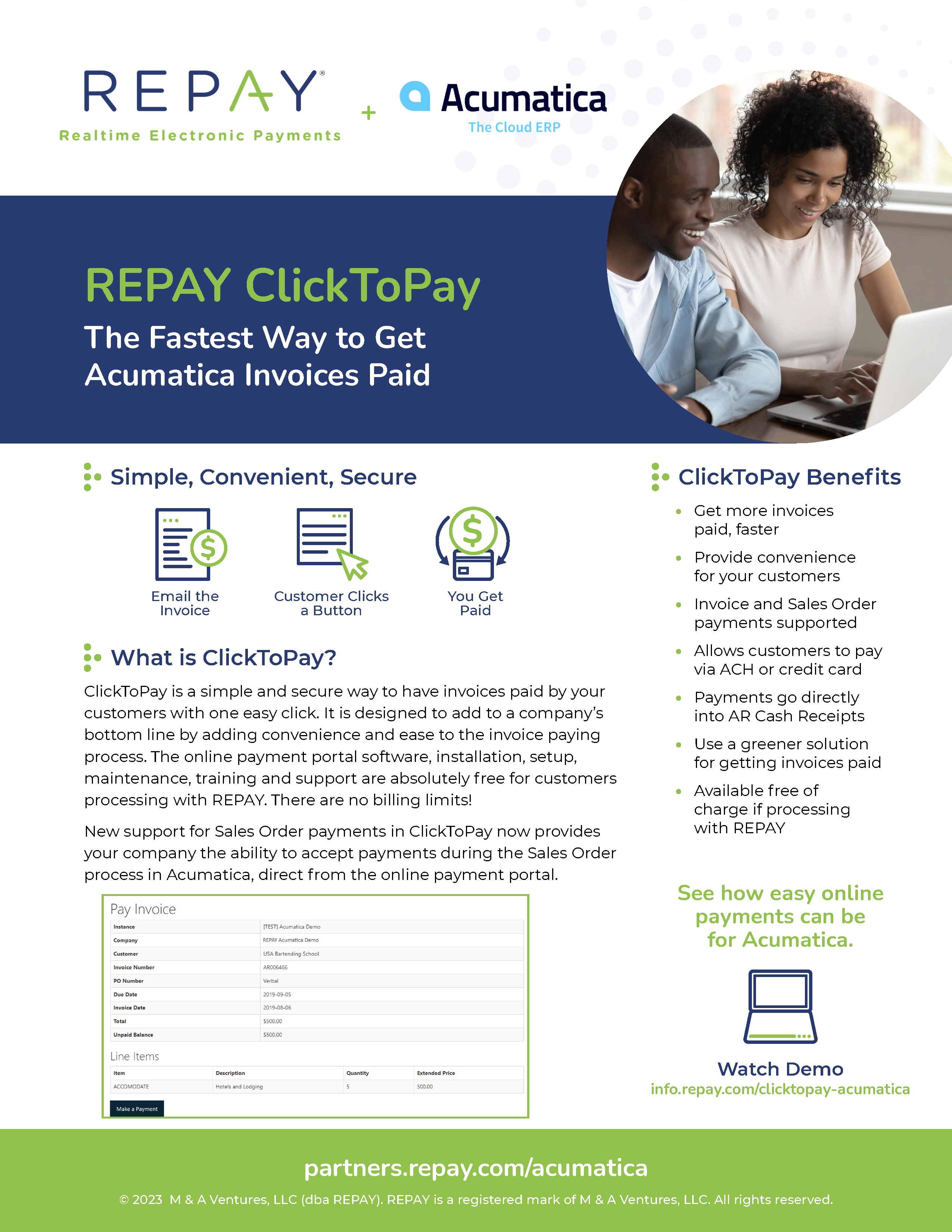

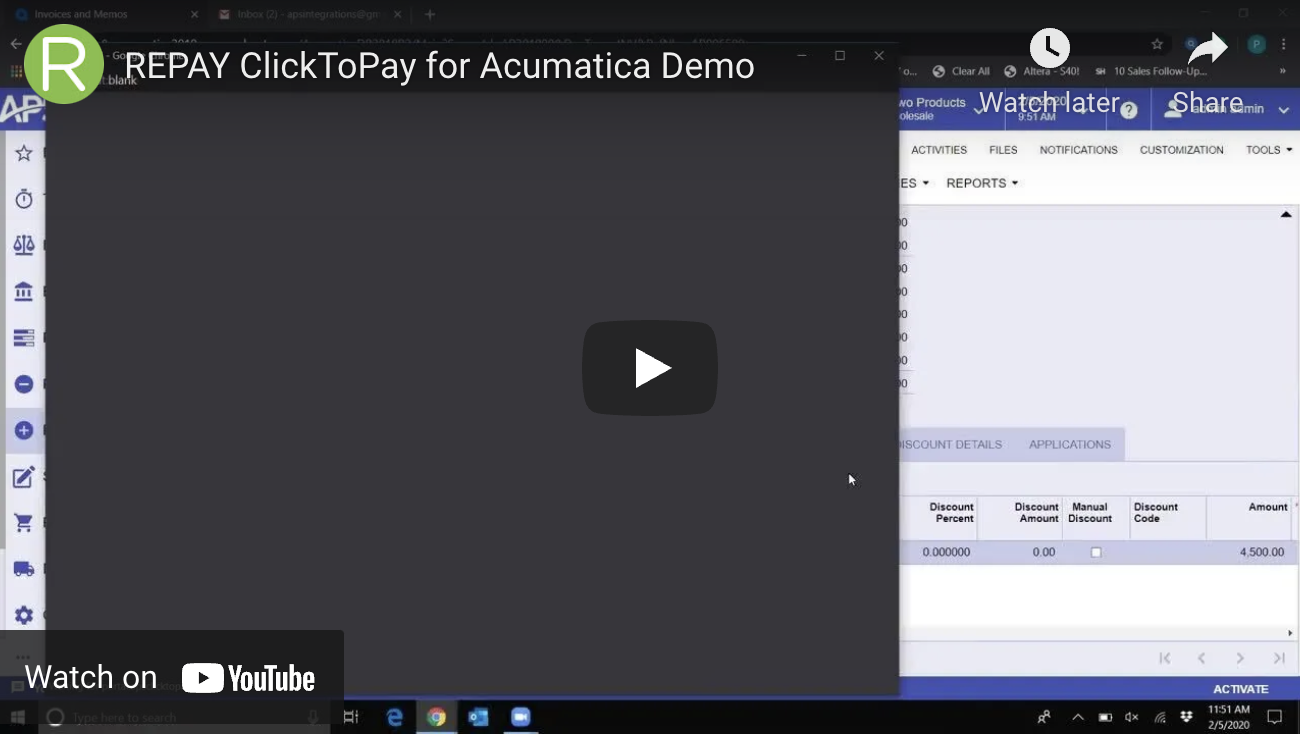

Acumatica ClickToPay

Introducing the latest advance for Bank-to-Bank transfers in neatly packaged web check technology: our exclusive ClickToPay Direct product can reduce chargeback replies to 72 hours for B2B transactions while allowing your customers to easily make secure transfers.

AccountMate

Integrated and Flexible. Work seamlessly within AccountMate to avoid manual entry and reduce error with an integrated payment processing solution.

Adagio

Integrated and Flexible. Work seamlessly within Adagio to avoid manual entry and reduce error with an integrated payment processing solution.

Hospitality Payments

Work seamlessly within the hospitality business systems you already use to avoid manual entry and reduce error with an integrated payment processing solution.

Magento

Our Magento-ready hosted form via iFrame is perfect for developers, partners, and merchants to adopt as a part of their payment processing solution. Our REPAY developers designed the Magento integrate payments with seamless integration to lower your transactions cost and increase your security. This hosted form captures customer information and collects sensitive cardholder data, reducing the PCI-DSS scope for Magento and your business operations.

WooCommerce

Work seamlessly within WooCommerce to avoid manual entry and reduce error with an integrated payment processing solution.

PrestaShop

Work seamlessly within PrestaShop to avoid manual entry and reduce error with an integrated payment processing solution.

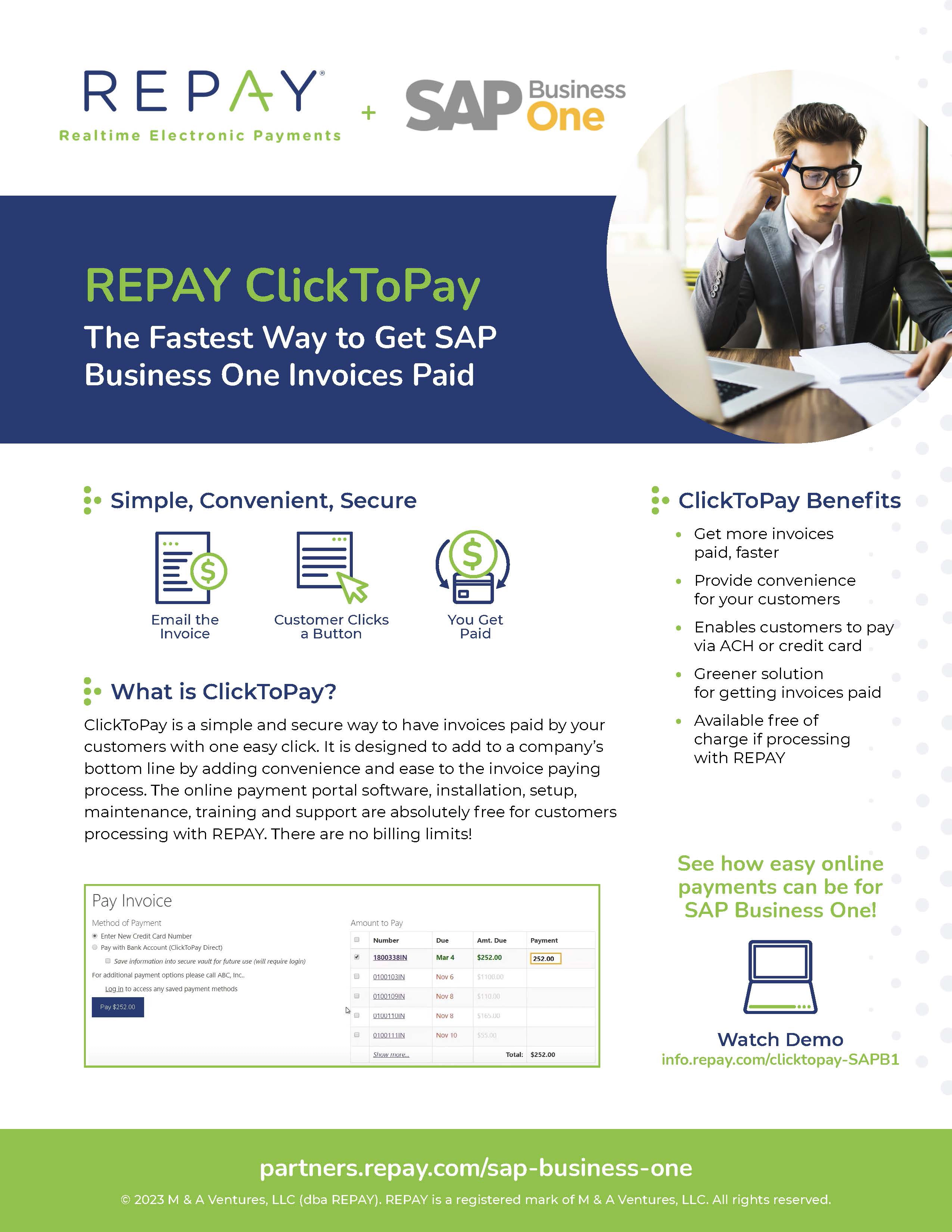

SAP Business One

Work seamlessly within SAP Business One to avoid manual entry and reduce error with an integrated payment processing solution.

SAP Business One ClickToPay

Introducing the latest advance for Bank-to-Bank transfers in neatly packaged web check technology: our exclusive ClickToPay Direct product can reduce chargeback replies to 72 hours for B2B transactions while allowing your customers to easily make secure transfers.

Auto Dealer Payments

REPAY is endorsed by AIADA. We leverage our expertise in the auto dealer payments industry to provide dealers with omni-channel payment options.

YayPay

Work seamlessly within the business systems you already use to automate payments and collections for a more efficient receivables management process

Lockstep Collect

Work seamlessly within the business systems you already use to automate payments and collections for a more efficient receivables management process

Miva

Work seamlessly within Miva eCommerce to avoid manual entry and reduce error with an integrated payment processing solution.

BigCommerce

Work within BigCommerce to avoid manual entry and reduce error with an integrated payment processing solution.

REPAY Payments General Overview

REPAY is an all-in-one processor that offers flexible and integrated payment solutions for every business.

xkzero by iSales

Work seamlessly on your mobile device within Sage 100 to avoid manual entry and reduce error with an integrated payment processing solution.

Zen Cart

Work within Zen Cart to avoid manual entry and reduce error with an integrated payment processing solution.

OpenCart

Work within OpenCart to avoid manual entry and reduce error with an integrated payment processing solution.

Sage 300 ClickToPay

ClickToPay is a simple and secure way to have invoices paid by your customers with one easy click. It is designed to add to a company’s bottom line by adding convenience and ease to the invoice paying process.

Sage X3

Work within Sage X3 to avoid manual entry and reduce error with an integrated payment processing solution.

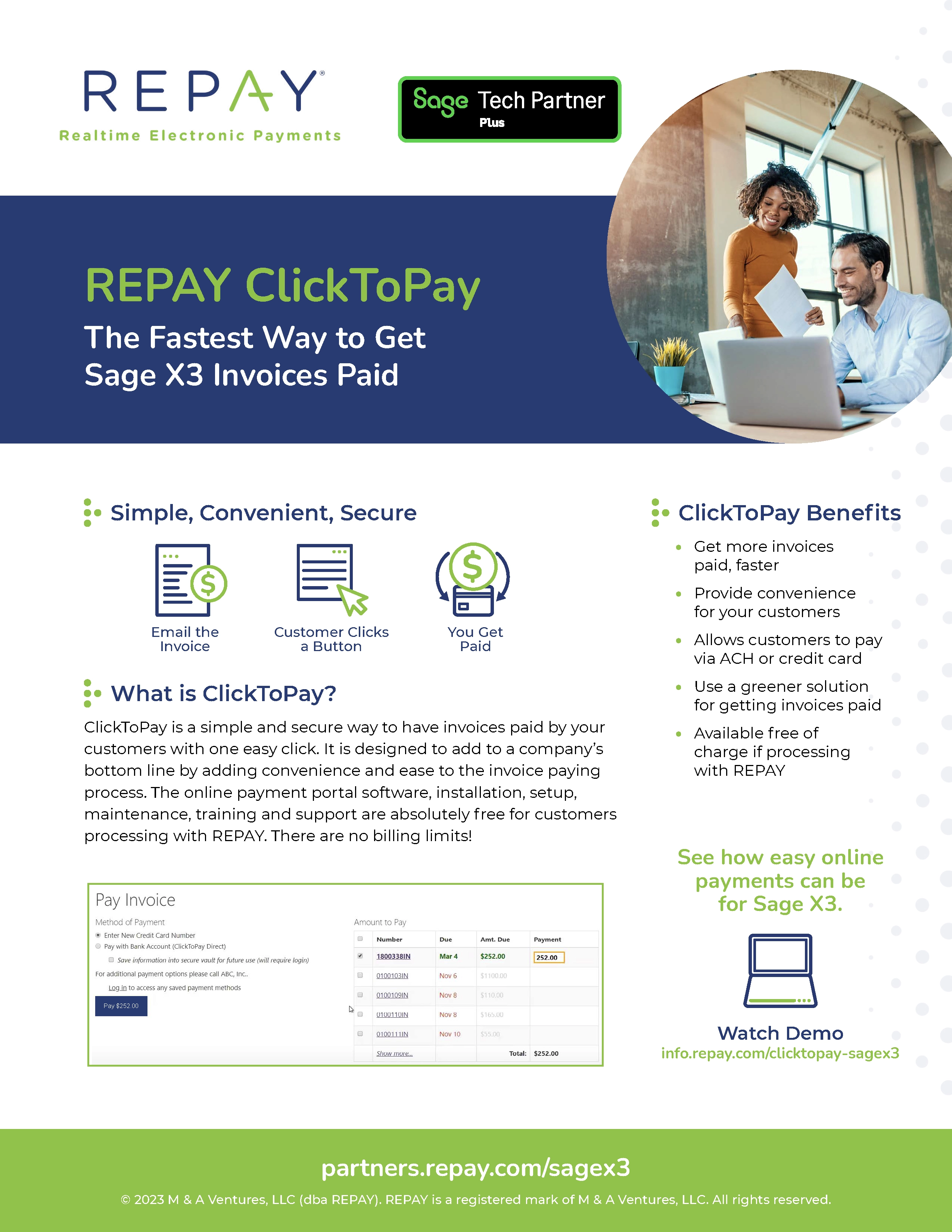

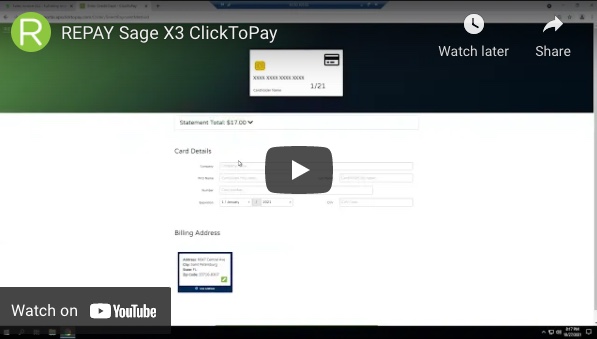

Sage X3 ClickToPay

ClickToPay is a simple and secure way to have invoices paid by your customers with one easy click. It is designed to add to a company’s bottom line by adding convenience and ease to the invoice paying process.

Salesforce CRM

Work seamlessly within the business systems you already use to automate payments, avoid manual entry, and reduce error with an integrated payment processing solution.

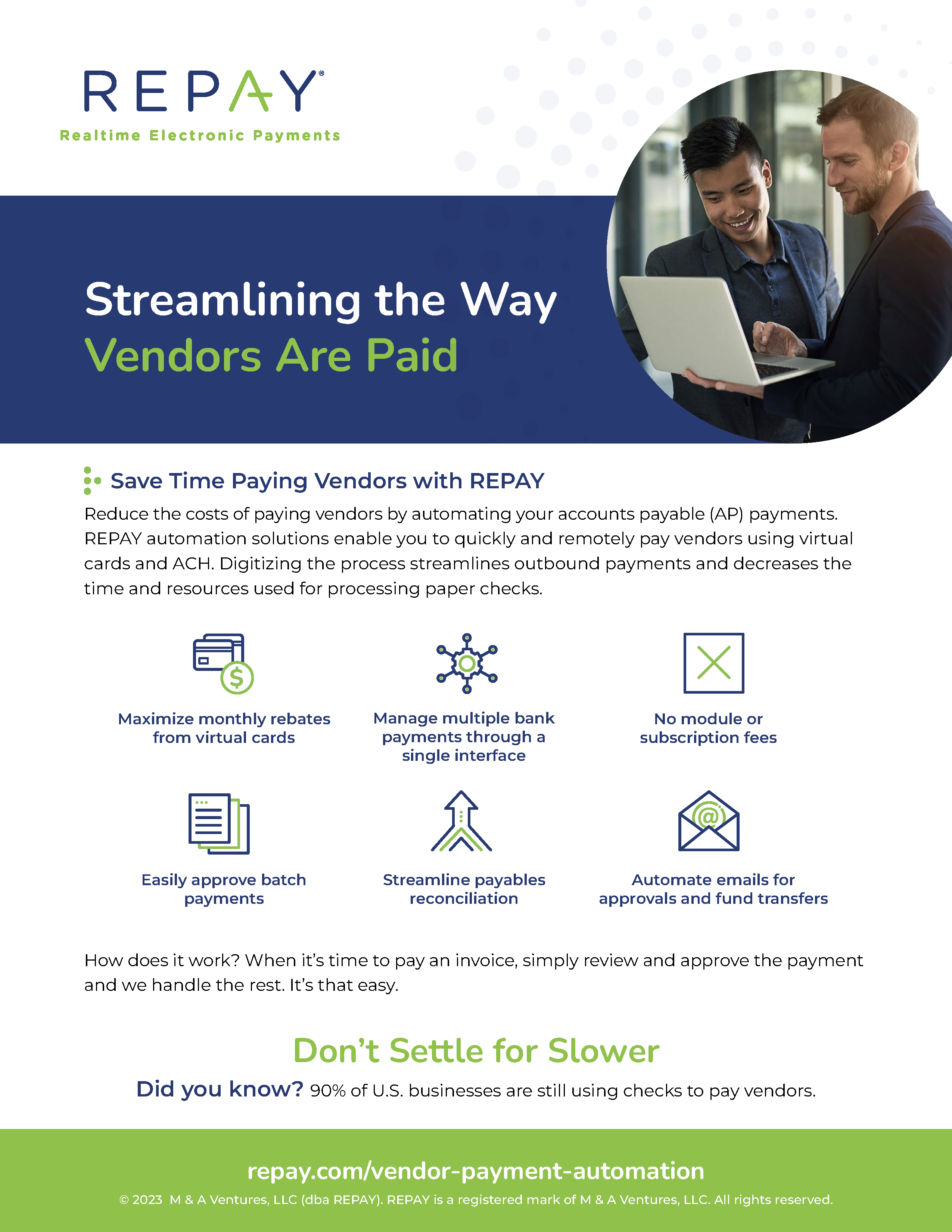

AP Vendor Payments Datasheet

REPAY allows you to reduce the costs of paying vendors by check. Easily approve invoices remotely, pay vendors, and reduce Accounts Payable (AP) costs with automation.

EFT

EFT supports digital customer payments, both one-time and recurring. Faster than traditional cheque processing, EFT debits occur on the date a payment is due, and you know almost immediately if you have been paid. Processing fewer cheques in favor of EFT not only saves you time and eliminates costly paper processes, but also reduces manual errors and cuts the risk of fraud.

Integrated Payment Solutions for Auto Lenders

Experts in the automotive industry, REPAY has built modern payment solutions tailored to meet your unique needs. Integrated directly to the Dealer Management System (DMS) you use every day, you can securely accept borrower payments 24/7/365 from wherever they are.

Instant Funding for Credit Unions

Instant Funding on REPAY’s payment platform, combined with Visa® and Mastercard’s® reliable global network and distribution systems, helps you deliver fast, convenient, and secure loan disbursements.

Accounts Receivable Management

Backed by a team of experts and years of experience in the Accounts Receivable Management (ARM) industry, REPAY offers modern payment solutions that integrate seamlessly into the ARM ecosystem.

Paydit

Integrated directly to your Paydit Accounts Receivable Management (ARM) system, REPAY’s payment tools support anytime, anywhere payments, whether you are an in-house collections team, third party collector, or a debt buyer.

Vergent

Integrated directly to the Vergent Loan Management System (LMS) you already use, REPAY’s payment tools support anytime, anywhere payments.

AutoAction

Integrated directly to the AutoAction Dealer Management System (DMS) you already use, REPAY’s payment tools support anytime, anywhere payments.

CBS

Integrated directly to the CBS and CAMS-ii core system you already use, REPAY’s payment tools support anytime, anywhere payments, against any loan type, including mortgages, auto loans, and home equity lines of credit.

ICE Mortgage Technologies

Integrated directly to the Encompass® loan servicing platform, REPAY’s digital payment tools support more efficient ways to pay without the hassle of paper checks.

LoanPro

Integrated directly to your LoanPro Accounts Receivable Management (ARM) system, REPAY’s payment tools support anytime, anywhere payments, whether you are an in-house collections team, third party collector, or a debt buyer.

AR & AP Better Together Datasheet

Whether you make B2B payments or collect them, REPAY’s payment technology can simplify and optimize both AP and AR without requiring separate systems.

AP Vendor Payments Automation for Acumatica

Streamline your vendor payments with a simple and effective Acumatica Accounts Payable (AP) Vendor Payments integration.

AP Vendor Payments Automation for Sage 100

Streamline your vendor payments with a simple and effective Sage 100 Accounts Payable (AP) Vendor Payments integration.

Sage Intacct

Integrated and Flexible. Work seamlessly within Sage Intacct to avoid manual entry and reduce entry error with an integrated payment processing solution for Sage Intacct.

Showing of results

Events

ACA International Convention & Expo

July 20 - 22, 2022

.png)

Miva Camp

August 10-12, 2022 | The ultimate learning and networking event for Miva merchants and partners.

TIADA Conference

July 24-26, 2022

Lend 360

September 12-14, 2022

Jack Henry Connect

August 29 - September 1, 2022

Showing of results

Explainer Videos

Level 3 B2B Payments Explainer Video

Level 3 processing allows you to receive discounted rates on Visa and MasterCard B2B payments. The REPAY integration automatically send the required data points for you, to ensure quick payments at a lower costs.

Introducing REPAY

Accept payments from customers and make payments to vendors – we help you do it all! Our platform supports anytime, anywhere digital payments through one seamless integration.

REPAY AP Vendor Automation

Simplify Your Vendor Payables. Eliminate paper checks and take advantage of cost-savings from virtual card rebates.

Showing of results

Lunch Bites Videos

REPAY and Herrington Technology Lunch Bite

Overcoming B2B Limits with Optimized Payments with REPAY and Herrington Technology

REPAY and Vrakas/Blum Lunch Bite

The Right B2B Payment Method with Sage 100 Generates Success

REPAY and DCKAP Lunch Bite

Payments Plus eCommerce in a Digital First World

Showing of results

Product Demos

Sage 100 ClickToPay

The fastest way to get Sage 100 invoices paid with no additional cost. Watch the demo video to learn more.

Sage 100 Payment Demo

The fastest way to get Sage 100 invoices paid with no additional cost. Watch the demo video to learn more.

Sage 100 AP Vendor Payments Demo

REPAY makes it easier for Sage 100 users to pay vendors with our Accounts Payable (AP) Vendor Payments automation solution. Watch the Sage 100 AP Vendor Payments demo video to learn more.

Sage 300 Product Demo

Watch this video to learn how easy integrated credit card processing can be for Sage 300.

Sage 300 ClickToPay

The fastest way to get Sage 300 invoices paid with no additional cost. Watch the demo video to learn more.

Sage 300 Payment Batch Processing

Watch the demo video to learn more about Payment Batch Processing for Sage 300.

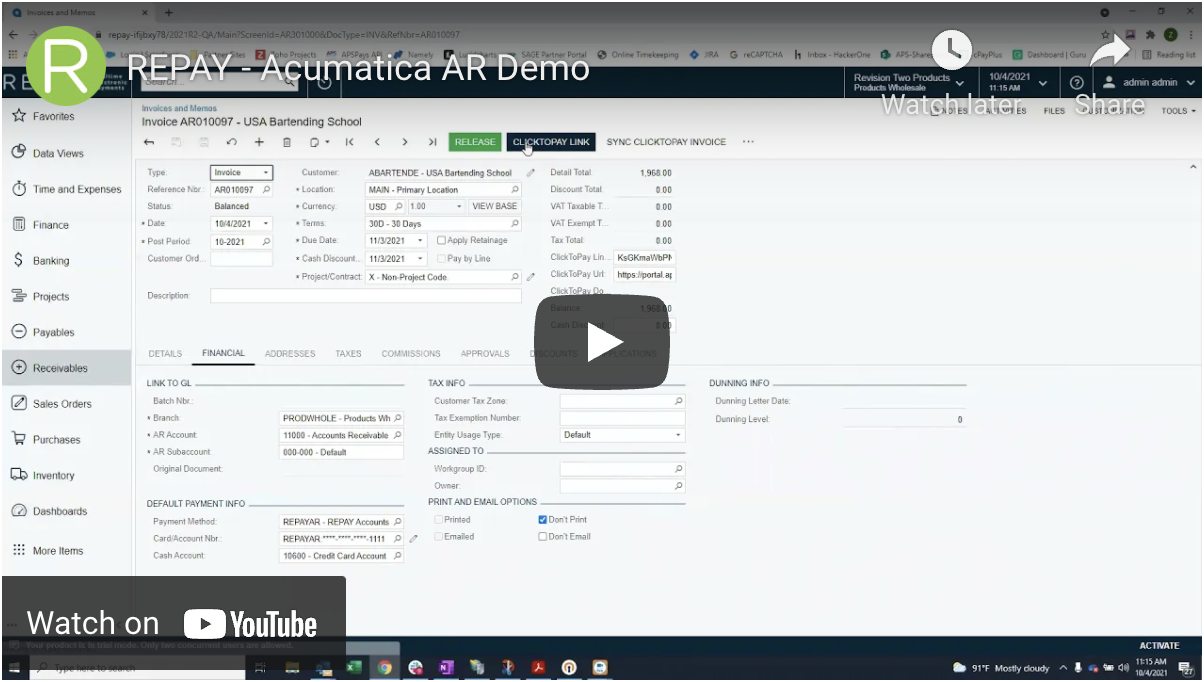

Acumatica Payments Demo

The fastest way to get Acumatica invoices paid with no additional cost.

Acumatica ClickToPay

The fastest way to get Acumatica invoices paid with no additional cost.

Acumatica AP Vendor Payments Demo

REPAY makes it easier for Acumatica users to pay vendors with our Accounts Payable (AP) Vendor Payments automation solution. Watch the Acumatica AP Vendor Payments demo video to learn more.

Sage X3 Payments Demo

Watch this video to learn how easy integrated credit card processing can be for Sage X3.

Magento Payments Demo

The fastest way to get Magento invoices paid with no additional cost. Watch the demo video to learn more.

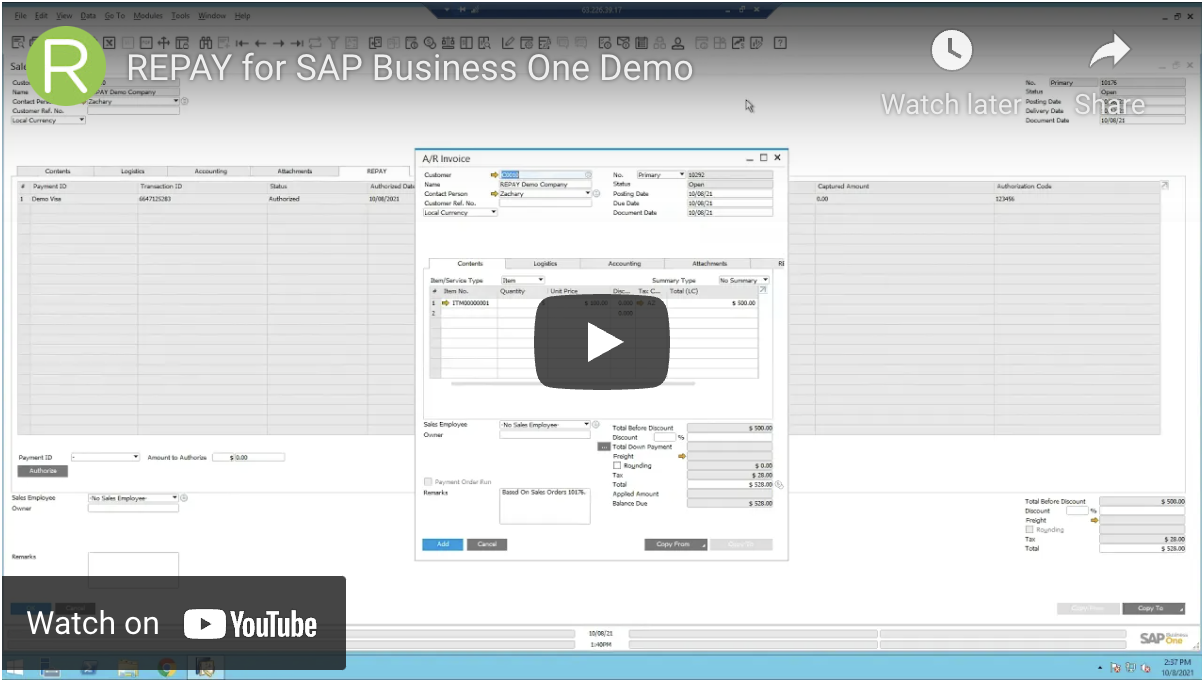

SAP Business One Payments Demo

Watch this video to learn how easy integrated credit card processing can be for SAP Business One.

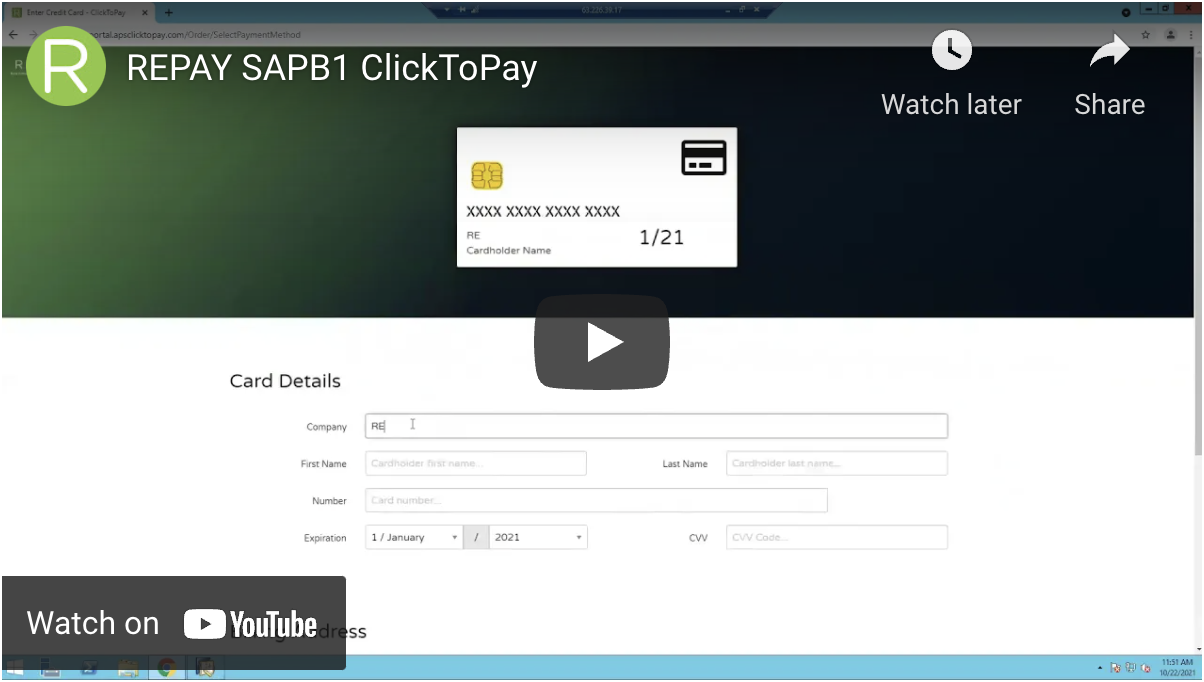

SAP Business One ClickToPay

The fastest way to get SAP Business One invoices paid with no additional cost. Watch the demo video to learn more.

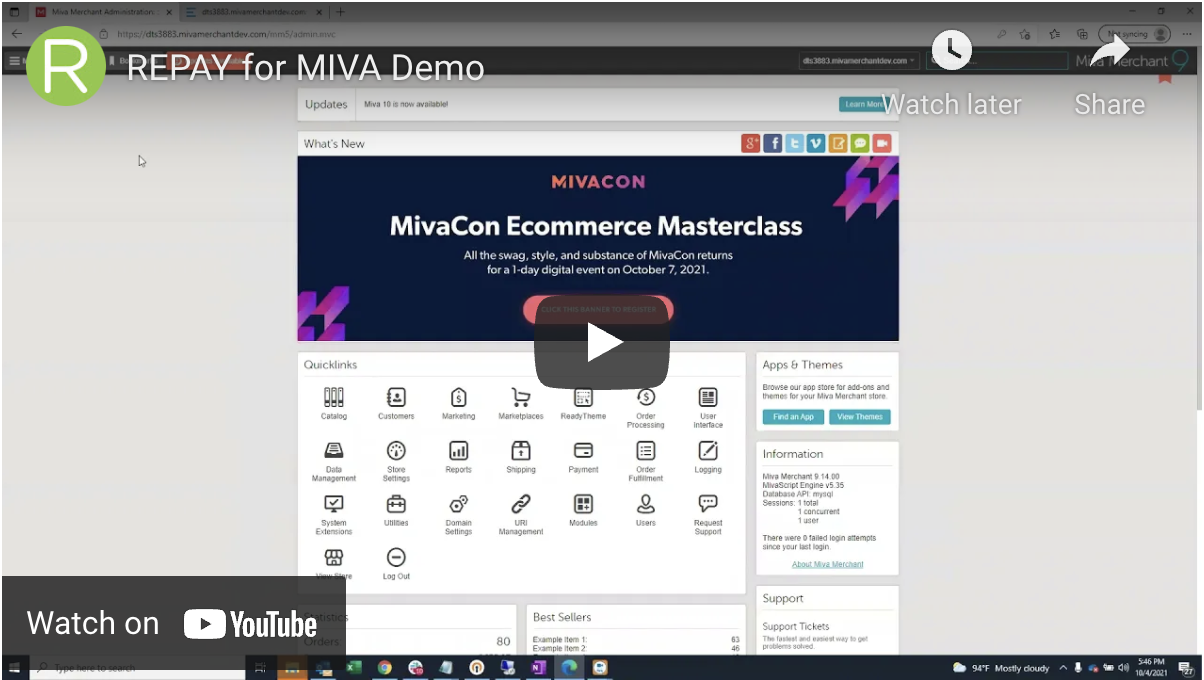

Miva Payment Demo

The fastest way to get Miva invoices paid with no additional cost. Watch the demo video to learn more

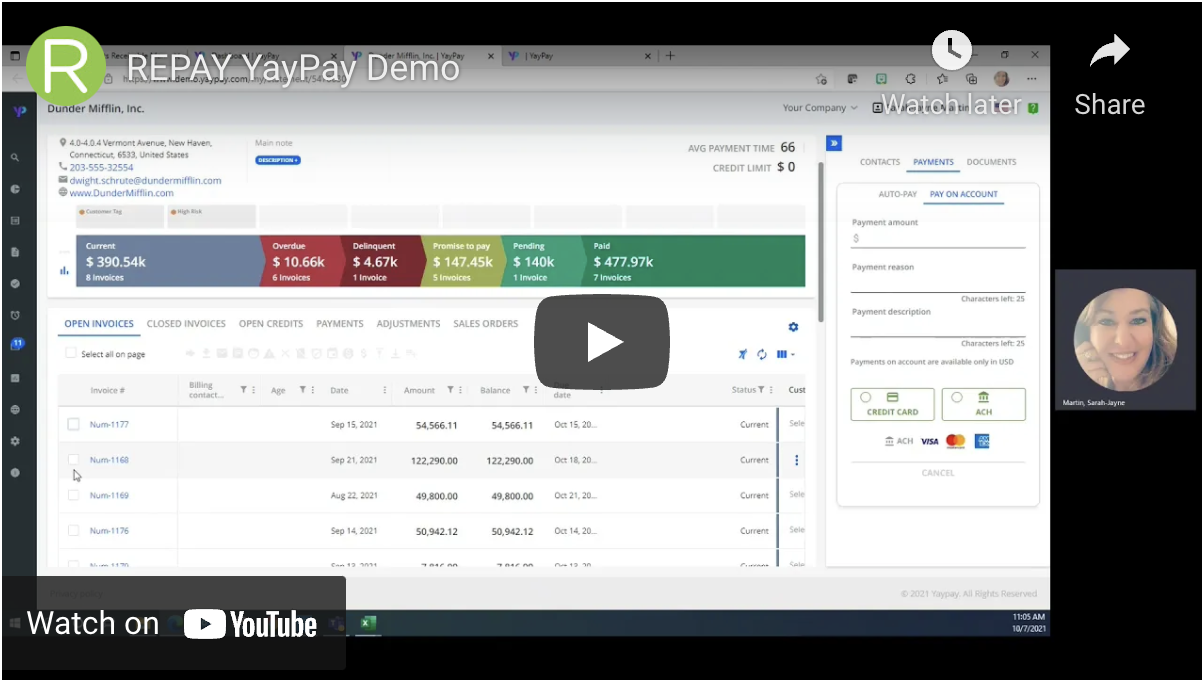

YayPay Payment Demo

The fastest way to get YayPay invoices paid with no additional cost. Watch the demo video to learn more.

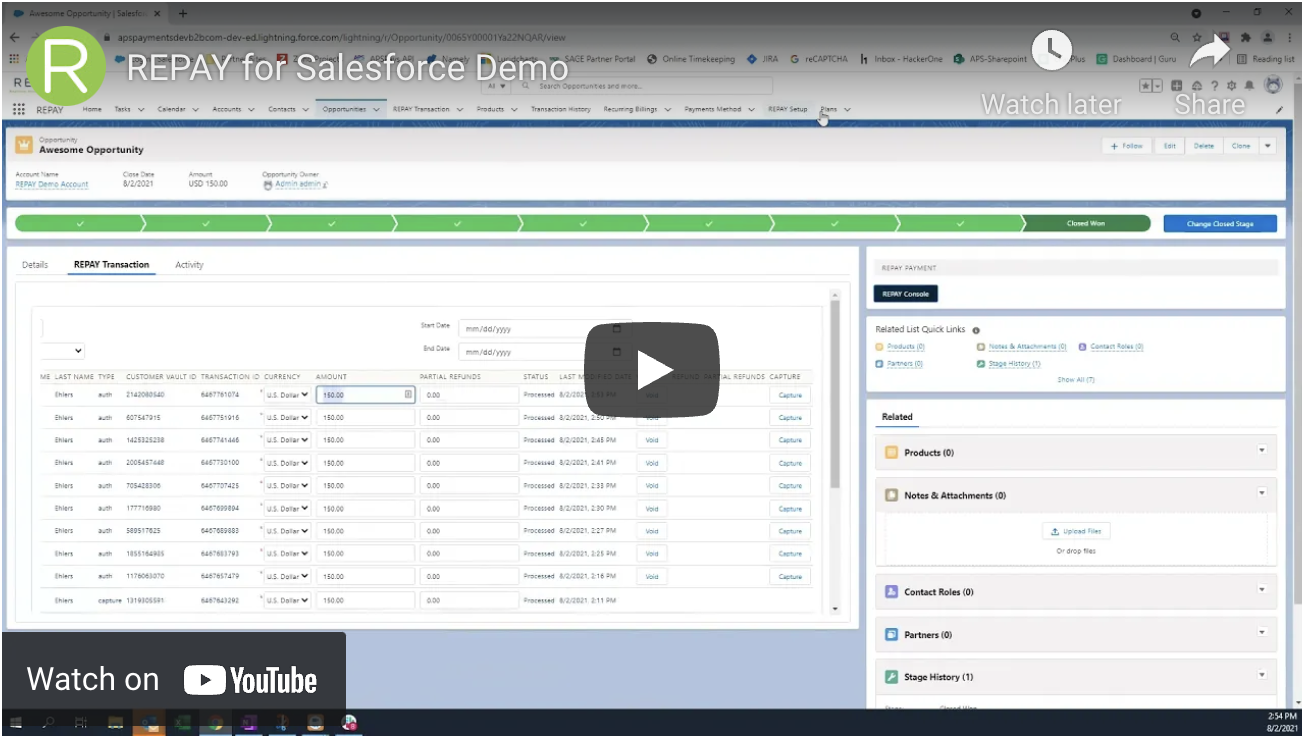

Salesforce Product Demo

Watch this short video to learn how easy integrated payments can be for Salesforce.

Sage X3 ClickToPay

The fastest way to get Sage X3 invoices paid with no additional cost.

Showing of results

Webinars

Showing of results

Whitepapers

Merchant's Guide to Integrated Payment Processing

You don’t have to know everything about payments in order to get the best rates for your business. This guide will go through some of the finer points of credit card processing, important definitions, and how the whole ecosystem works.

2021 Payment Trends

2021 Payment Trends

Avoid Common Payment Pitfalls

Learn how to avoid common payment pitfalls by understanding what successful businesses consider when working with a payments provider.

Merchant's Guide to PCI Compliance

Read this whitepaper to learn how you can get ahead on PCI Compliance and ensure that you have selected a trusted PCI Compliant processor for your business.

AR & AP Payments: Better Together

Read this whitepaper to learn the benefits of modernizing your AP & AR Payments.

Digital Customer Engagement Whitepaper

You’ve heard of digital customer engagement, but are you getting the most out of it?

Showing of results